They talk about going in balls deep…. But I’ve fucked messed up.

So I had a decent pot of £26k saved and looked at this as my nestegg. Do I invest in a cheeky buy to let? Could see a potential of £350 a month after the mortgage repayment but I wanted the easy life. Well that’s what I thought.

I read The Simple Path to Wealth by the genius JL Collins, I looked at Vanguards fund and saw a decent little drop in value, people were starting to get a little twitchy about the Corona Virus and I thought of the G himself Warren Buffett, ‘Whilst most people are fearful…. Be greedy.’ So in I went hungry for the big gains…

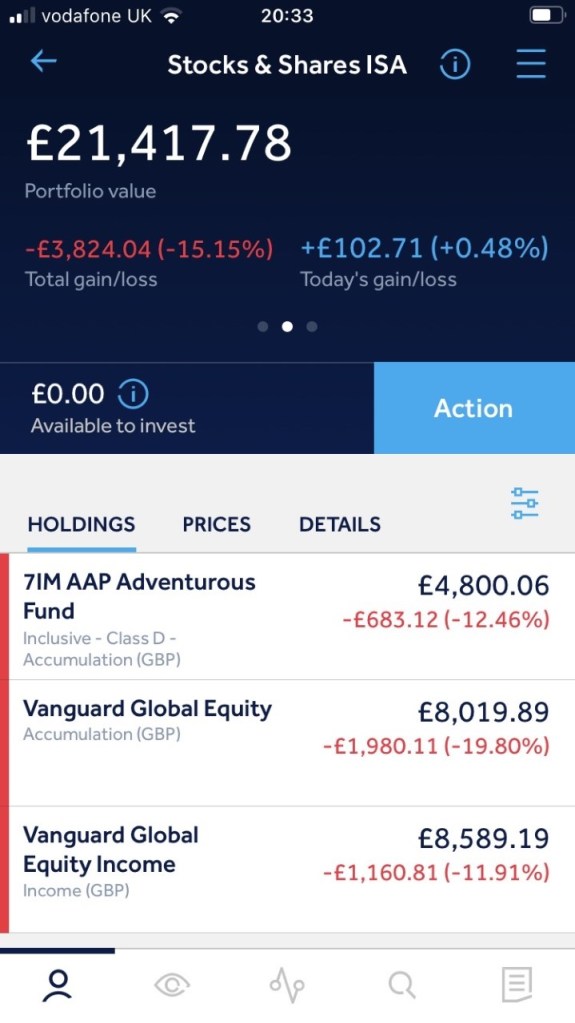

Sadly,I false started by 3 weeks. Originally, when I pressed that ‘deal’ button on my Hargreave Landsdown account on 10k, I felt like Leonardo DiCaprio in the Wolf of Wall Street or even the song ‘all that power’ … 3 weeks later…. HOLY BALL BAGS I have lost over 4 grand what an absolute fuckwit. Ironically, the egotistical side of me still feels like the Wolf of Wall but the part on his first day on Wall Street.

Fortunately for me, I work a hectic 9-5, well technically more of a 7:30 to 6 so I can’t sit at home and get emotionally attached to the financial rollercoaster that’s going on in the news. I did on one occasion log into my Hargreaves Landsdown account 3 times in 3 days… I realised my downfall and deleted the app. It was tough I can’t lie but declines in a well diversified equity portfolio are temporary.

Here we are in the middle of the Corona Pandemic and OMG je suis shitting mon pantaloons!!!!!! I’m genuinely feeling like Neil from the Inbetweeners describing to Mr Gilbert his first experience of sexual intercourse. With thoughts of ‘do I stay in, do I pull out, maybe it could go deeper.’

My golden rules.

When I pressed that deal button I never imagined the market to plummet the way it has but I made a sacrifice to myself and I’m going to stick to the plan. I knew when I was investing in a 100% equity; it was a risky portfolio which can go up and down but I know in the long term where my portfolio will go. I made a calculated decision to put that money away for my long term future. I don’t need to touch it hopefully for decades.

When it fell by another 10% I decided to buy even more thinking the market had bottomed out but it’s simply impossible to time the market and my goodness, I have seen some terrible losses. But I hold my nerve, as I’m all in with my cash, I wait for the next pay check, pay myself first and look forward to the 5th April, which is the new ISA tax year. Without trying to sound even more miserable, I hope the market doesn’t shoot up now as I’d love to put even more money in at this price, once I have been paid. Long term, these heavy declines will be just a dip in the market and it’s a gift for those investing in the long term. But I can’t lie, it’s a tough pill to swallow. However, I have invested in a globally diversified portfolio, so whilst the majority of the world are just coming into the pandemic, China are (fingers crossed) coming back into normality, coming out the other side and so is their stock market.

Although the UK and the rest of the world have to face facts with the Corona Virus. Without sounding like a bad break-up song, it is going to get worse before it gets better. It will take a lot of time but once it does, my golly gosh we are in for a ride. The amount of money big bad Boris is pumping into the economy, we are going to seeing a JME serious BOOM. He is pumping in BILLIONS upon BILLIONS!!! Downing Street better have a bloody good printer with a lot of cartridges. He is in such a difficult situation and there is no correct answer but give it 10 years, we are certainly going to see the implications of the cash injections with my prediction of an 08 style boom & crash. Although, looking at economic cycles, these crashes are inevitable.

Anyway….. Enough waffling and check out my ISA portfolio. Yes it’s a site for sore eyes at the moment, the financial advisors will be grinning from ear to ear, you can guarantee their pearly whites will be thinking he should have seeked professional advice… Maybe I should have…. Hindsight is a great tool.