Depending on the news you read or your confirmation biases will have a huge impact as to which asset class is the best investment. Before we break down the numbers, let’s look at the positives and negatives to both.

Buy to Let – Positives

Investments will not fluctuate massively invalue, as a result of this, you won’t be checking the value of the property, which will result in you not getting emotionally attached and selling low.

2. With history being our guide, property should double every 10 years on average.

3.You are earning an income instantly once you have received the keys for the property, that is ofcourse if the numbers are correct and you haven’t purchased to flip/renovate.

Negatives

Huge financial costs to get started, when I show you a random example, you can see for yourself, especially with the governments tax changes, additional 3% stamp duty and the increase in tax.

You maybe able to earn an income instantly, this will depend on your tenant but if you have a bad one and need to go through the lengthy eviction process, it could take you up to 3 months to evict them. You could get a rent guarantee but this is another cost.

There is also an additional hassle and cost of what if the boiler breaks? What happens if the roof starts leaking and the general wear and tear of the property. Walls needing a lick of paint, replacing carpets, kitchens etc.

Index Funds

Positives: You can start investing instantly, even with as little as £50 you can have ‘skin in the index.’

You do not have to worry about additional unexpected costs, you have a fixed yearly fee you have to pay and that’s it 0.48%.

Without trying to sound like Sainsburys, you can click and collect forget. You will not have to worry about tenants being evicted, EPC’s, yearly gas safety checks etc.

You do not have to pay tax on your first 20k if you invest through your ISA and with history being our guide, over the long term the market goes one way.

Negatives

You could get emotionally attached to your portfolio. Are you prepared to see your portfolio half in a short term decline? Or even a recession?

There is a potential or your investment not increasing in value for 5 years potentially longer, if you invest in the peak, would you be able to cope with that?

The Showdown

So we are going to take ourselves back 6 years to 2014, both the property markets and index funds have seen some pretty impressive growth. Lets say, your not interested in research, negotiating and buying property and you’d prefer to use a respectable sourcing company and you are happy to pay the additional £4000 to find you a deal.

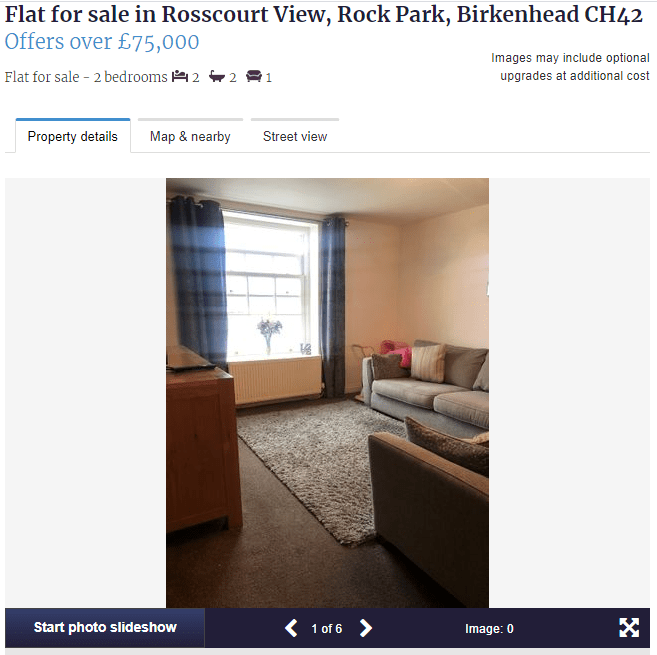

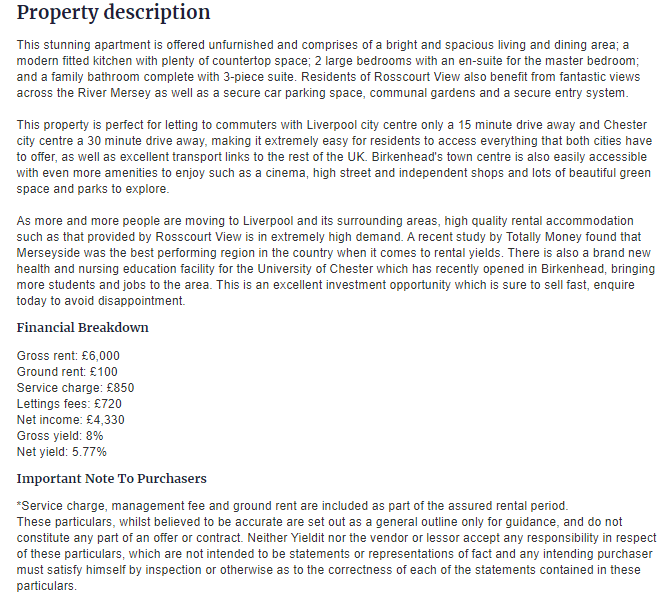

Here is a real-life example buy to let

In 2014, you could have purchased a large 2 bed flat through this company at £72,000. Lets also add the additional fees too.

25% of £72000 is round about £17000 (deposit required)+ stamp duty £3000 + finders fee £4000 + solicitors fee £900 + mortgage brokers £500 + tenant finders fee £300 = £25700

Rental income £500 a month (£6000) a year

Total Mortgage Amount= £72000-£25700= £55000

Monthly Expenses

Interest Only Monthly Mortgage Payment (2.13%) = £105 a month

Insurance= £10 a month

Ground rent and service charge – £80 (£950 a year)

Agency Management fee (7%) = £42 a month

Total Monthly expenses = £237 a month

Monthly Repairs/Vacancy Loss/Remortgage fees when 2 year mortgage fix expires (Average) = £60 a month

£500 – £297 =£203 return each month

Yearly total income: £2436

Original Amount invested (reminder): £25700

Net Rental Yield of: 9.48%

There are also additional fees such as accountants and a 20% tax on profit. This examples is also grade 2 listed…. Which means very expensive renovation costs.

Furthermore, there is also the added bonus of capital growth but looking at this specific example, there hasn’t been any growth. Just for proof…. This is a large 2 bed flat in the same block that is currently up for sale in 2020. I maybe wrong here but looking at the evidence, unless a miracle happens, this property price is certainly not going to double every 10 years and I don’t think it was at a 20% discount! This property is also listed… lets not hope any structural work/maintenance needs doing as the councils cost could be phenomenal!

So if I multiply the total yearly income of £2436 x 6 years = £14 616 profit (minus potential tax)

Net Return of 58% over 6 years.

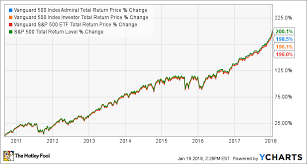

Index Investing – Vanguards Global Equity Fund

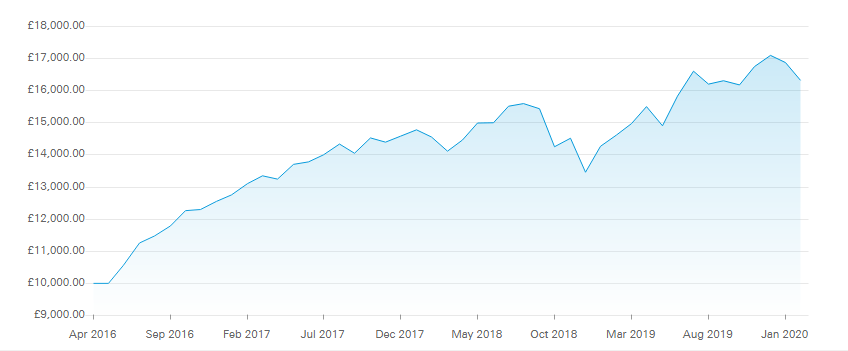

Here ia a graph that demonstrates the result of an initial and only investment of £10,000 over last 5 years (it was difficult to find 6).

So over 5 years it look like a profit of round about £6000 if 10k was invested. However, the original investment that was put into the property investment was just over £25,000. in a Vanguard Global Equity Fund you would have seen an estimate return of just over £15,000 without any tax as it could kept in the ISA.

5 year net return of 60%.

Lets not forget, all you had to do was click a button and forget. No dealing with estate agents, insurances, mortgage brokers and gas/electricals safety checks!

Conclusion

Well Vanguards return has out paced the property sourcer. But the question you need to ask yourself is, are you comfortable buying and holding? This is an agressive, high risk fund. Will you get figgity if your index fund declines by 20% even 40% for the long term gains? In an Index investors world, 5 years is a very very short amount of time. I haven’t taken into account of the yearly 0.48% fees of the Vanguard fund but on the other hand I have not taken into consideration the power of compounding. If this money was compounded it would be an even bigger return.

An additional point I will add is I do feel this has been a very poor example of not seeing any capital growth on the property. I hope I’m wrong but from my laptop research, scanning sites & price history, there has been no capital gain.

This is merely my opinion, you may argue I have looked more favourably on one asset class but I have tried to be as balanced as possible.